ClaimCenter Business Analyst - Mammoth Proctored Exam

Last Update 1 day ago

Total Questions : 50

Dive into our fully updated and stable ClaimCenter-Business-Analysts practice test platform, featuring all the latest Guidewire Certified Professional exam questions added this week. Our preparation tool is more than just a Guidewire study aid; it's a strategic advantage.

Our Guidewire Certified Professional practice questions crafted to reflect the domains and difficulty of the actual exam. The detailed rationales explain the 'why' behind each answer, reinforcing key concepts about ClaimCenter-Business-Analysts. Use this test to pinpoint which areas you need to focus your study on.

A commercial auto claims group at Succeed Insurance has a large number of overdue activities related to service requests. Reviewing the distribution of these activities across the team, the supervisor sees that one Adjuster on the team owns only one of these activities, while the other Adjusters own five or six.

To expedite completion of these activities, the Supervisor decides that the Adjuster with one service request activity will handle all of the overdue service activities for the team.

Which screen can the Supervisor use to most efficiently reassign these service request activities?

Succeed Insurance has a strategic initiative to offer pay-as-you-drive personal auto insurance to compete with other large carriers. Customers who choose these policies must either own a vehicle that is equipped with a monitoring device or agree to install a device provided by Succeed. The monitoring device collects information about how the drivers of a covered vehicle drive, including how fast they drive, how hard they brake, and how many miles/kilometers the vehicle travels within a policy period.

This information is logged, and premiums are based on how the insured's driving behavior is categorized. When a claim is reported, the log files must be obtained to analyze the information captured by the monitoring device at the time of the incident.

Succeed plans to collect and evaluate the Vehicle Monitoring Log files in the first implementation phase, which is scheduled for release in 60 days. The project sponsors have instructed the implementation team to use base product functionality over customization. Integration should be leveraged where possible to avoid manual data entry.

No payments can be made on the claim until a flag indicating that the Vehicle Monitoring Log file has been processed has been set to 'Yes'.

Which feature of the base product prevents payments from being made on the claim?

To optimize business process workflow, an insurer has spent a great deal of effort on estimating the amount of effort required to complete various types of work... They are also aware that certain situations may require specialized expertise and want to incorporate this in their decision making.

All claims and exposures are entered using only the ClaimCenter new claim wizard. Once entered, the work should be automatically distributed fairly to those properly suited, as determined by the company's knowledge of each worker's skill set.

Which two assignment mechanisms, alone or together, will achieve their goal? (Choose two.)

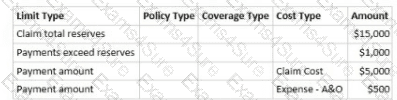

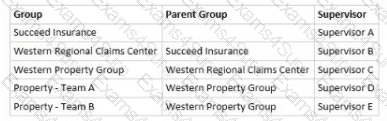

An Adjuster at Succeed Insurance is handling a homeowners claim with a dwelling exposure for damage to the insured's home. The Adjuster's Authority Limit Profile has the following limits:

The table below is a view of the property claims organization within Succeed Insurance. The Adjuster is a member of the group Property - Team

A.

The Adjuster creates a payment in the amount of $6,500 for repairs to the insured's home. How will it be processed assuming that the claim has sufficient reserves for the payment?

Satisfied with the outcome of a Requirements Workshop, a Business Analyst (BA) attributed the success to preparation. The assigned task had been to document the requirements for capturing details on vehicle incidents for Personal Auto.

Before the session, the BA reviewed ClaimCenter functionality by creating a new Personal Auto Claim involving physical damage to a vehicle.

During review, the BA saw that ClaimCenter did not have a graphical representation of a vehicle with clickable hot spots to identify the damage areas like they have in their current application.

Upon further research, the BA found that Guidewire does offer this functionality and even provides a Graphical Incident Capture Accelerator to ease implementation.

During the workshop, the BA was able to clearly present all options for capturing vehicle incident details. Instead of having to develop the Vehicle Incident Capture functionality from scratch, the team was able to make a quick decision to add this functionality and end the meeting 30 minutes early.

Which two outcomes demonstrate the importance of preparing for a Requirements Workshop by becoming familiar with the features and functionality of ClaimCenter? (Choose two.)

To help manage new user setup, Succeed Insurance would like all manager-level employees to be able to add new users to ClaimCenter. Some managers are already assigned the Community Admin role, which has a set of permissions for the administration of the ClaimCenter community model that includes the permission to create new users.

Where are two places the Business Analyst (BA) can go to view the permissions assigned to manager-level users? (Choose two.)

Succeed Insurance has a requirement to add a new high-risk indicator to the Claim Status screen for property claims that have a lien on the property. A new icon will be added to the configuration to provide a visual indicator making it easier for Adjusters and other ClaimCenter users to determine that a claim has a lien.

Which two common areas of the user interface (UI) can display the new lien icon? (Choose two.)

A sales executive and business traveler has a full coverage auto policy through his insurance company. The executive lives in Detroit, Michigan and often drives across the border to visit client offices in Canada.

While driving in downtown Toronto, the executive's car was hit by a truck coming the wrong way. He called his insurance company to report a claim for this accident. However, the Customer Service Representative (CSR) cannot confirm there is an active policy on file.

How should this claim be handled?

When capturing information about a damaged vehicle, Succeed Insurance requires that the total distance driven (miles/km) for the vehicle be captured as well. What is the best practice for a Business Analyst (BA) to determine if ClaimCenter already has a field to capture distance driven?

Succeed Insurance allows field Adjusters to write checks directly to the insured to cover damage costs for minor claims such as:

Personal auto claims involving cracked windshields

Homeowners claims involving minor glass breakage

The Adjuster uses the Manual Check Wizard to record the check number and amount against a reserve line. Succeed requires Supervisor approval for all manual checks to ensure that the paper checks are verified against the payment information in ClaimCenter.

Which two limits or rules must be configured in ClaimCenter to ensure that these manual payments are sent to the correct person for approval? (Choose two.)

TESTED 07 Feb 2026

Hi this is Romona Kearns from Holland and I would like to tell you that I passed my exam with the use of exams4sure dumps. I got same questions in my exam that I prepared from your test engine software. I will recommend your site to all my friends for sure.

Our all material is important and it will be handy for you. If you have short time for exam so, we are sure with the use of it you will pass it easily with good marks. If you will not pass so, you could feel free to claim your refund. We will give 100% money back guarantee if our customers will not satisfy with our products.