Payroll Fundamentals 1Exam

Last Update 4 days ago

Total Questions : 73

Dive into our fully updated and stable PF1 practice test platform, featuring all the latest Payroll Fundamentals exam questions added this week. Our preparation tool is more than just a National Payroll Institute study aid; it's a strategic advantage.

Our free Payroll Fundamentals practice questions crafted to reflect the domains and difficulty of the actual exam. The detailed rationales explain the 'why' behind each answer, reinforcing key concepts about PF1. Use this test to pinpoint which areas you need to focus your study on.

Phan was employed fromMarch 1, 1992throughJanuary 10, 2007. He was not a member of the organization’s pension plan. Calculate the number of years eligible for the$1,500.00portion of a retiring allowance.

What is the portion of a retiring allowance eligible to be transferred into a Registered Retirement Savings Plan (RRSP) or a registered pension plan (RPP) tax free based on?

Ursula is 17 years old, works in Quebec and earns $750.00 weekly. Ursula pays weekly union dues of $18.00 along with a special weekly union assessment of $10.00 for construction of a new union hall for its members. Ursula also has registered pension plan (RPP) contributions of $20.00 deducted from each pay. Calculate Ursula’s net federal taxable income.

How many pay periods will be used to calculate insurable earnings inBlock 15Bon the Record of Employment if the employee is paidweekly?

Dollar amounts that are paid to an employee to cover expenses that they incurred while performing their job, but are not considered in the calculation of an employee’s earnings are:

PF1 Exam – Net Pay Calculation (Template Worksheet)

Scenario

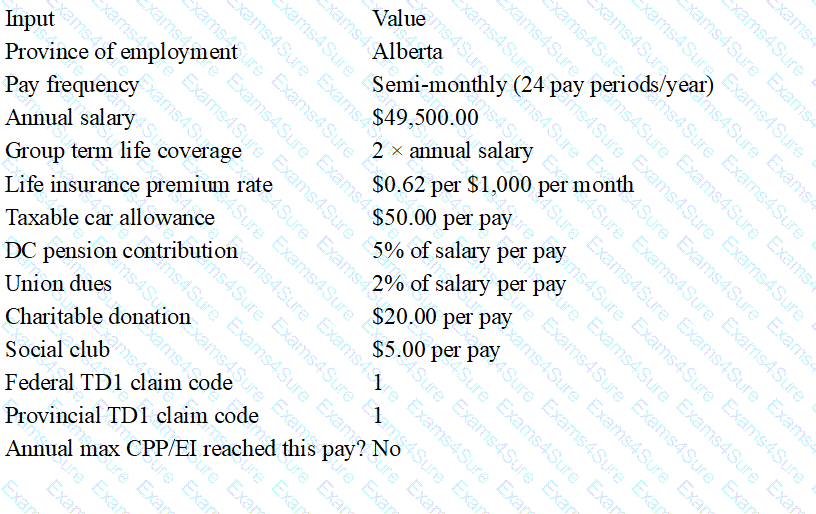

Diane Lemay works for Monarch Construction in Alberta and earns an annual salary of $49,500.00, paid on a semi-monthly basis.

The company provides its employees with group term life insurance coverage of two times annual salary and pays a monthly premium of $0.62 per $1,000.00 of coverage.

Diane uses her car to meet with clients on company business and receives a taxable car allowance of $50.00 per pay.

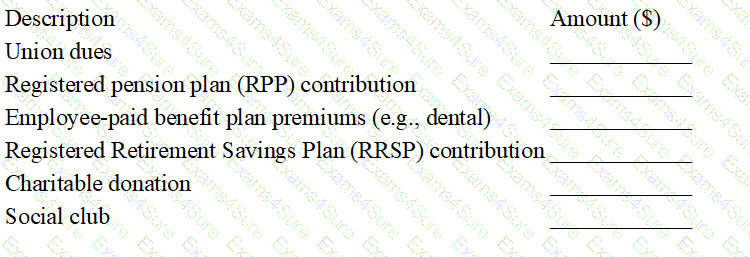

The company has a defined contribution pension plan to which Diane contributes 5% of her salary each pay.

Diane also contributes $20.00 to United Way and has $5.00 deducted for her social club membership each pay. She belongs to a union and pays 2% of her salary in union dues per pay period.

Diane’s federal and provincial TD1 claim codes are 1. She will not reach the first Canada Pension Plan or Employment Insurance annual maximums this pay period.

Required: Calculate the employee’s net pay, following the order of the steps in the net pay template.

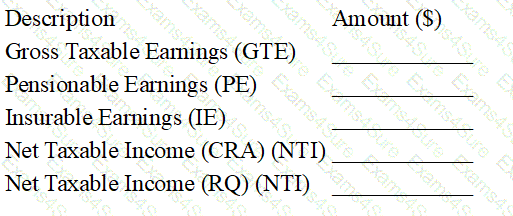

EXHIBIT A — Net Pay Template (Fill in all blanks)

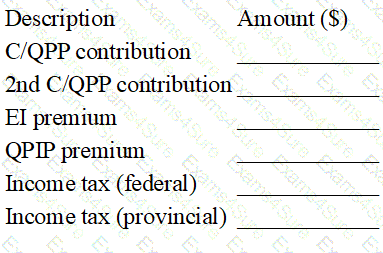

STATUTORY DEDUCTIONS

OTHER DEDUCTIONS

Given Data (Reference)

Step 1 — Calculate the employee’s gross taxable earnings (GTE) for this pay.

[ _________________________________ ]

Step 2 — Calculate the pensionable earnings (PE).

[ _________________________________ ]

Step 3 — Calculate the insurable earnings (IE).

[ _________________________________ ]

Step 4 — Calculate the net taxable income (CRA) (NTI).

[ _________________________________ ]

Step 5 — Calculate the net taxable income (RQ) (NTI).

[ _________________________________ ]

Step 6 — Calculate Diane’s Canada Pension Plan contribution.

[ _________________________________ ]

Step 7 — Calculate Diane’s Employment Insurance premium.

[ _________________________________ ]

Step 8 — Calculate Diane’s Quebec Parental Insurance Plan premium.

[ _________________________________ ]

Step 9 — Determine Diane’s federal income tax.

[ _________________________________ ]

Step 10 — Determine Diane’s provincial income tax.

[ _________________________________ ]

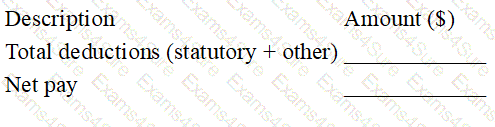

Step 11 — Calculate Diane’s total deductions (statutory + other).

[ _________________________________ ]

Step 12 — Calculate Diane’s net pay.

[ _________________________________ ]

TESTED 22 Feb 2026

Hi this is Romona Kearns from Holland and I would like to tell you that I passed my exam with the use of exams4sure dumps. I got same questions in my exam that I prepared from your test engine software. I will recommend your site to all my friends for sure.

Our all material is important and it will be handy for you. If you have short time for exam so, we are sure with the use of it you will pass it easily with good marks. If you will not pass so, you could feel free to claim your refund. We will give 100% money back guarantee if our customers will not satisfy with our products.