Financial Strategy

Last Update 5 days ago

Total Questions : 435

Financial Strategy is stable now with all latest exam questions are added 5 days ago. Incorporating F3 practice exam questions into your study plan is more than just a preparation strategy.

By familiarizing yourself with the Financial Strategy exam format, identifying knowledge gaps, applying theoretical knowledge in CIMA practical scenarios, you are setting yourself up for success. F3 exam dumps provide a realistic preview, helping you to adapt your preparation strategy accordingly.

F3 exam questions often include scenarios and problem-solving exercises that mirror real-world challenges. Working through F3 dumps allows you to practice pacing yourself, ensuring that you can complete all Financial Strategy exam questions within the allotted time frame without sacrificing accuracy.

On 1 January 20X1, a company had:

• Cost of equity of 10 0%.

• Cost of debt of 5.0%

• Debt of $100Mmilion

• 100 million $1 shares trading at $4.00 each.

On 1 February 20X1:

• The company's share police fell to $3.00.

• Debt and the cost of debt remained unchanged

The company does not pay tax.

Under Modigliani and Miller's theory without lax. what is the best estimate of the movement in the cost of equity as a result of the fall in ne share price?

HHH Company has a fixed rate loan at 10.0%, but wishes to swap to variable. It can borrow at the risk-free rate +8%. The bank is currently quoting swap rates of 3.1% (bid) and 3.5% (ask). What net rate will HHH Company pay if it enters into the swap?

A new company was set up two years ago using the personal financial resources of the founders.

These funds were used to acquire suitable premises.

The company has entered into a long-term lease on the premises which are not yet fully fitted out.

The founders are considering requesting loan finance from the company's bank to fund the purchase of custom-made advanced technology equipment.

No other companies are using this type of equipment.

The company expects to continue to be profitable for the forseeable future.

It re-invests some of its surplus cash in on-going essential research and development.

Which THREE of the following features are likely to be considered negatives by the bank when assessing the company's credit-worthiness?

A company plans to raise $12 million to finance an expansion project using a rights issue.

Relevant data:

• Shares will be offered at a 20% discount to the present market price of $15.00 per share.

• There are currently 2 million shares in issue.

• The project is forecast to yield a positive NPV of $6 million.

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

A listed company has recently announced a profit warning.

The company's share price fell 20% on the day of the announcement but had been fairly static in the weeks leading up to the announcement.

Which form of efficient market is most likely to be indicated by this share price movement?

Which THREE of the following methods of business valuation would give a valuation of the equity of an entity, rather than the value of the whole entity?

The financial assistant of a geared company has prepared the following calculation of the company's equity value:

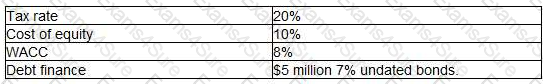

Useful information;

• Tax rate - 20%

• Cost of equity = 12%

• Weighted average cost of capital (WACC)« 10%

" Debt finance of the company comprises a $6 million 7% undated bond trading at par Valuation workings.

Which of the following errors has been made by the financial assistant?

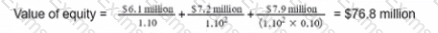

A company is in the process of issuing a 10 year $100 million bond and is considering using an interest rate swap to change the interest profile on some or all of the $100 million new finance.

The company has a target fixed versus floating rate debt profile of 1:1. Before issuing the bond its debt profile was as follows:

Which of the following is the most appropriate interest rate swap structure for the company?

A company plans to raise $12 million to finance an expansion project using a rights issue.

Relevant data:

• Shares will be offered at a 20% discount to the present market price of $15.00 per share.

• There are currently 2 million shares in issue.

• The project is forecast to yield a positive NPV of $6 million.

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

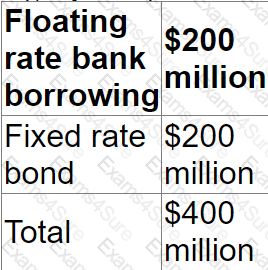

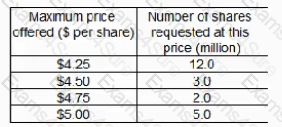

RST wishes to raise at least $40 million of new equity by issuing up to 10 million new equity shares at a minimum price of $3.00 under an offer for sale by tender. It receives the following tender offers:

What is the maximum amount that RST can raise by this share issue?

(Give your answer to the nearest $ million).

An unlisted company:

Which of the following methods would be the most appropriate to value this company’s equity?

Company YZZ has made a bid for the entire share capital of Company ZYY

Company YZZ is offering the shareholders in Company ZYY the option of either a share exchange or a cash alternative

Which THREE of the following would be considered disadvantages of accepting the cash consideration for the shareholders of Company ZYY?

A company needs to raise $40 million to finance a project. It has decided on a right issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $10.00 per share.

G purchased a put option that grants the right to cap the interest on a loan at 10.0%. Simultaneously, G sold a call option that grants the holder the benefits of any decrease if interest rates fall below 8.5%.

Which THREE possible explanations would be consistent with G's behavior?

A company has identified potential profitable investments that would require a total of S50 million capital expenditure over the next two years The following information is relevant.

• The company has 100 million shares in issue and has a market capitalisation of S500 million

• It has a target debt to equity ratio of 40% based on market values This ratio is currently 30%

• Earnings for the current year are expected to be S1 00 million

• Its last dividend payment was $1 per share One of the company's objectives is to increase dividends by at least 10% each year

• The company has no cash reserves

Which of the following is the most suitable method of financing to meet the company's requirements?

A company is considering the issue of a convertible bond compared to a straight bond issue (non-convertible bond).

Director A is concerned that issuing a convertible bond will upset the shareholders for the following reasons:

• it will dilute their control

• the interest payments will be higher therefore reducing liquidity

• it will increase the gearing ratio therefore increasing financial risk

Director B disagrees, and is preparing a board paper to promote the issue of the convertible bond rather than a non-convertible.

Advise the Director B which THREE of the following statements should be included in his board paper to promote the issue of the convertible bond?

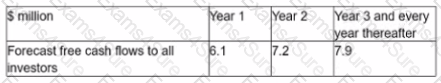

A company proposes to value itself based on the net present value of estimated future cash flows.

Relevant data:

• The cash flow for the next three years is expected to be £100 million each year

• The cash flow after year 3 will grow at 2% to perpetuity

• The cost of capital is 12%

The value of the company to the nearest $ million is:

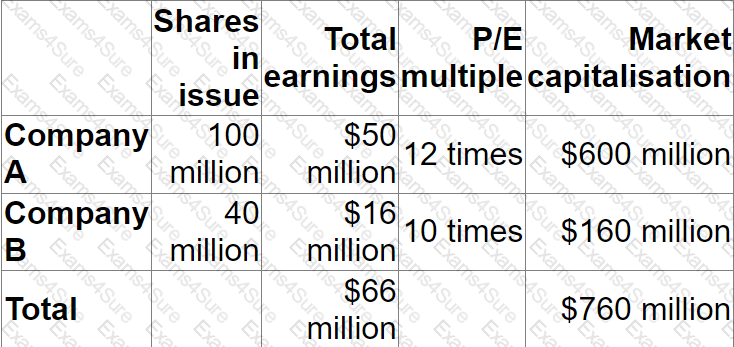

Company A plans to acquire Company B in a 1-for-1 share exchange.

Pre-acquisition information is as follows:

Post-acquisition information is as follows:

If the acquisition proceeds, what is the expected percentage increase in the post acquisition share price of Company A?

A company's directors plan to increase gearing to come in line with the industry average of 40%. They need to know what the effect will be on the company's WAC

C.

According to traditional theory of gearing the WACC is most likely to:

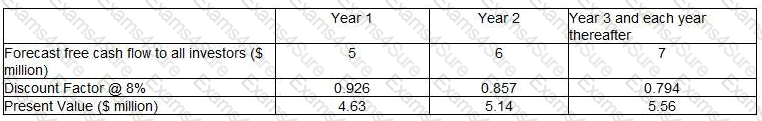

Company BBB has prepared a valuation of a competitor company, Company BB

D.

Company BBB is intending to acquire a controlling interest in the equity of Company BBD and therefore wants to value only the equity of Company BBD.

The directors of Company BBB have prepared the following valuation of Company BBD:

Value of Equity = 4.63 + 5.14 + 5.56 = S15.33 million

Additional information on Company BBD:

Which THREE of the following are weaknesses of the above valuation?

Z wishes to borrow at a floating rate and has been told that it can use swaps to reduce the effective interest rate it pays. Z can borrow floating at Libor ' 1, and fixed at 10%.

Which of the following companies would be the most appropriate for Z to enter into a swap with?

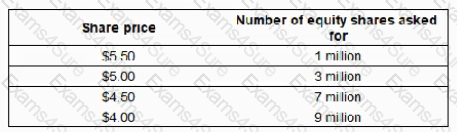

Company C invests heavily in Research and Development an need to raise $45 million to finance future projects. It has decided to use equity finance raised by a tender offer, The following tender offers have been received from potential investors:

Company C wishes to select an offer price that will project shareholders from a significant dilution of control but still raise the required amount of finance.

What offer price should Company C’s select?

Which THREE of the following are considered in detail in IFRS 7 Financial Instruments: Disclosures?

A company plans to cut its dividend but is concerned that the share price will fall. This demonstrates the _____________ effect

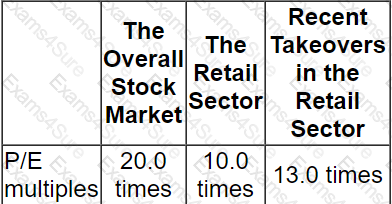

Company T is a listed company in the retail sector.

Its current profit before interest and taxation is $5 million.

This level of profit is forecast to be maintainable in future.

Company T has a 10% corporate bond in issue with a nominal value of $10 million.

This currently trades at 90% of its nominal value.

Corporate tax is paid at 20%.

The following information is available:

Which of the following is a reasonable expectation of the equity value in the event of an attempted takeover?

A listed company with a growing share price plans to finance a four-year research project with debt.

The main criterion for the finance is to minimise the annual cashflow payments on the debt.

The research will be sold at the end of the project.

Which of the following would be the most suitable financing method for the company?

An unlisted company operates in a niche market, exploring the west coast of Africa for new oiI reservoirs.

The oil exploration program has been successful in recent years and t now has a substantial amount of oil reserves with a high level of certainty of being recoverable Under financial reporting regulations, oil still in the ground is not recognised as an asset unit is extracted.

The expense of the exploration program has used up all the company’s available cash resources.

The company has denied to list or a stock market and raise finds through an initial public offering to finance its drilling program.

Which of the following valuation methods in the appropriate to use in calculating an initial listing price for this company?

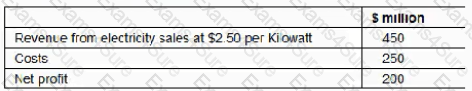

A company generates and distributes electricity and gas to households and businesses.

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $2.00 per Kilowatt.

The company expects this to cause consumption to rise by 15% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

A company is considering the issue of a convertible bond compared to a straight bond issue (non-convertible bond).

Director A is concerned that issuing a convertible bond will upset the shareholders for the following reasons:

• it will dilute their control

• the interest payments will be higher therefore reducing liquidity

• it will increase the gearing ratio therefore increasing financial risk

Director B disagrees, and is preparing a board paper to promote the issue of the convertible bond rather than a non-convertible.

Advise the Director B which THREE of the following statements should be included in his board paper to promote the issue of the convertible bond?

Country X's short-term interest rates are slightly higher than its long-term rates. Which THREE of the following statements are correct?

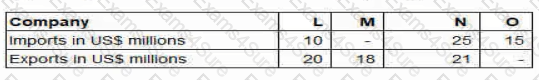

Companies L. M N and O:

• are based in a country that uses the RS as its currency

• have an objective to grow operating profit year on year

• have the same total levels of revenue and cost

• trade with companies or individuals in the United States. All import and export trade with companies or individuals in the United States is priced in US$.

Typical import/export trade for each company in a year are as follows:

Which company's growth objective is most sensitive to a movement in the USS / RS exchange rate?

Extracts from a company's profit forecast for the next financial year is as follows:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 2,000 million ordinary shares currently in issue and cancelling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

A company is currently all-equity financed with a cost of equity of 9%.

It plans to raise debt with a pre-tax cost of 3% in order to buy back equity shares.

After the buy-back, the debt-to-equity ratio at market values will be 1 to 2.

The corporate income tax rate is 25%.

Which of the following represents the company's cost of equity after the buy-back according to Modigliani and Miller's Theory of Capital Structure with taxes?

A company in country T is considering either exporting its product directly to customers in country P or establishing a manufacturing subsidiary in country P.

The corporate tax rate in country T is 20% and 25% tax depreciation allowances are available

Which TIIRCC of the following would be considered advantages of establishing a subsidiary in country T?

Company A has a cash surplus.

The discount rate used for a typical project is the company's weighted average cost of capital of 10%.

No investment projects will be available for at least 2 years.

Which of the following is currently most likely to increase shareholder wealth in respect of the surplus cash?

KKL is a listed sports clothing company with three separate business units. KKL is seeking to sell TT’, one of these business units

TTP cwns a new. brand of trail running shoes that have Droved hugely popular with lone distance runners. The management team of TTP are frustrated by the constraints imposes b/ KKL in managing tie brand and developing. the bus ness and they believe that TTF has huge growth potential.

The management team of TTP have approached KKL with a proposal to purchase 1~P through a management layout (MDO). KKL has accepted this proposal as TTP has not proved to be a good fit' with the rest of the business and has agreed on the selling price.

Which THREE of the following factors a-e mast Likely to affect the success of the MBO?

A company's latest accounts show profit after tax of $20.0 million, after deducting interest of $5.0 million. The company expects earnings to grow at 5% per annum indefinitely.

The company has estimated its cost of equity at 12%, which is included in the company WACC of 10%.

Assuming that profit after tax is equivalent to cash flows, what is the value of the equity capital?

Give your answer to the nearest $ million.

$ ? million

A company's Board of Directors is assessing the likely impact of financing future new projects using either equity or debt.

The directors are uncertain of the effects on key variables.

Which THREE of the following statements are true?

Company P is a pharmaceutical company listed on an alternative investment market.

The company is developing a new drug which it hopes to market in approximately six years' time.

Company P is owned and managed by a group of doctors who wish to retain control of the company. The company operates from leased laboratories with minimal fixed assets.

Its value comes from the quality of its research staff and their research.

The company currently has one approved drug which generates sufficient cashflow to cover day to day operations but not sufficient for major new research and development.

Company P wish to raise debt finance to develop the new drug.

Recommend which of the following types of debt finance would be most appropriate for Company P to help finance the development of this new drug.

PTT has a number of subsidiary companies around the world, including FTT based in Europe and CTT based in Indonesia

CTT purchases all of us raw materials from FTT CTT processes these materials and the resulting products are exported to several different countries CTT pays FTT in the Indonesian currency.

Indonesia's inflation is higher than that of FTTs home country

Which of the following statements are correct?

Select ALL that apply

Company A is subject to a takeover bid from Company B, both companies operate in the same industry and each of them demand a significant market share Company B h3S made an of an of $5 per share to the shareholders of Company

A.

The directors of Company A do not believe the takeover would be in the best interests of the stakeholders and other stakeholders of Company A due to the following reruns

1. Company B has recently taken ever several ether companies resulting in them breaking up the company and se ling on the assets.

2 The directors of Company A believe the offer of $5 per snare undervalues tie company

The directors of Company A are therefore keen to prevent the bid from going ahead

Which THREE of the following defence strategies could be used by the directors of Company Air this situation?

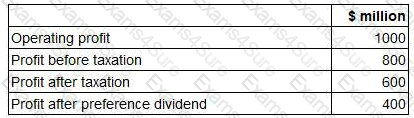

A company has in a 5% corporate bond in issue on which there are two loan covenants.

• Interest cover must not fall below 3 times

• Retained earnings for the year must not fall below $3.5 million

The Company has 200 million shares in issue.

The most recent dividend per share was $0.04.

The Company intends increasing dividends by 10% next year.

Financial projections for next year are as follows:

Advise the Board of Directors which of the following will be the status of compliance with the loan covenants next year?

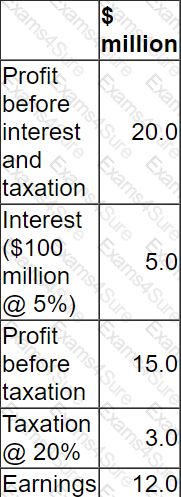

A wholly equity financed company has the following objectives:

1. Increase in profit before interest and tax by at least 10% per year.

2. Maintain a dividend payout ratio of 40% of earnings per year.

Relevant data:

• There are 2 million shares in issue.

• Profit before interest and tax in the last financial year was $5 million.

• The corporate income tax rate is 30%.

At the beginning of the current financial year, the company raised long term debt of $2 million at 10% interest each year.

Calculate the dividend per share that will be announced this year assuming the company achieves its objective of increasing profit before interest and tax by 10%.

A company’s statement of financial position includes non-current assets which are leased, the tax regime follows the accounting treatment.

Which cash flows should be discounted when evaluating the cost of lease finance?

A company is currently all-equity financed.

The directors are planning to raise long term debt to finance a new project.

The debt:equity ratio after the bond issue would be 30:60 based on estimated market values.

According to Modigliani and Miller's Theory of Capital Structure without tax, the company's cost of equity would:

Company A has agreed to buy all the share capital of Company

B.

The Board of Directors of Company A believes that the post-acquisition value of the expanded business can be computed using the "boot-strapping" concept.

Which of the following most accurately describes "boot-strapping" in this context?

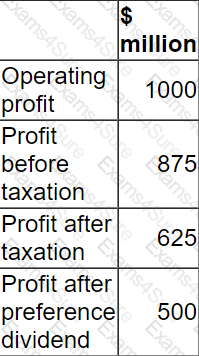

Extracts from a company's profit forecast for the next financial year as follows:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 1,250 million ordinary shares currently in issue and canceling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

A company is currently all-equity financed.

The directors are planning to raise long term debt to finance a new project.

The debt:equity ratio after the bond issue would be 40:60 based on estimated market values.

According to Modigliani and Miller's Theory of Capital Structure without tax, the company's cost of equity would:

The Board of Directors of a small listed company engaged in exploration are currently considering the future dividend policy of the company. Exploration is considered a high-risk business and consequently the company has a low level of debt finance.

Forecasts indicate a period of profit fluctuation in the next few years as the company is planning to embark on a major capital investment project. Debt finance is unlikely to be available due to the project's high business risk.

Which THREE of the following are practical considerations when determining the company's dividend/retention policy?

Company M plans to bid for Company J. Company M has 20 million shares in issue and a current share price of $10.00 before publicly announcing the planned takeover. Company J has 10 million shares in issue and a current share price of $4.00.

The directors of Company M are considering an all-share bid of 1 Company M shares for 2 Company J shares.

Synergies worth $20m are expected from the acquisition.

What is the likely change in wealth for Company M's shareholders (in total) if the bid is accepted?

Give your answer to the nearest $ million.

$ ? million

Company Z wishes to borrow $50 million for 10 years at a fixed rate of interest.

Two alternative approaches are being considered:

A.

Issue a 10 year bond at a fixed rate of 6%, or

B.

Borrow from the bank at Libor +2.5% for a 10 year period and simultaneously enter into a 10 year interest rate swap.

Current 10 year swap rates against Libor are 4.0% - 4.2%.

What is the difference in the net interest cost between the two alternative approaches?

The primary objective of a public sector entity is to ensure value for money is generated.

Value for money is defined as performing an activity so as to simultaneously achieve economy, efficiency and effectiveness

Efficiency is defined as:

It is now 1 January 20X0.

Company V, a private equity company, is considering the acquisition of 40% of the equity of Company A for a total amount of $15 million.

Company A has been established to develop a new type of engine which will be launched at the end of 20X1. Company A is forecasting that the new engine will result in free cash flows to equity of $2m in its first year of operation and that this will rise by 8% per year for the foreseeable future.

The new engine is the only commercial activity that Company A is involved in.

Company V intends to sell its stake in Company A when the new engine is launched.

Company A has a cost of equity of 12%.

Assuming that Company V receives an amount that reflects the present value of their shares in company

A.

what is the estimated annual rate of return to Company V from this investment? (To the nearest %)A company has just received a hostile bid. Which of the following response strategies could be considered?

A consultancy company is dependent for profits and growth on the high value individuals it employs.

The company has relatively few tangible assets.

Select the most appropriate reason for the net asset valuation method being considered unsuitable for such a company.

Company ABC's management has noticed that Company BCD has quickly built up a 20% stake by buying shares in Company ABC and are concerned that this is the start of a hostile bid.

This build-up of shares triggers the poison pill provision which automatically converts the rights to buy future preference shares previously issued to existing shareholders in Company ABC to full ordinary shares

What is the most likely impact of the triggering of a poison pill strategy at this stage in the bidding process?

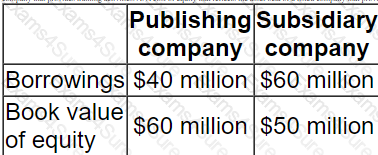

A listed publishing company owns a subsidiary company whose business activity is training.

It wishes to dispose of the subsidiary company.

The following information is available:

The board of the publishing company believe that the value of the subsidiary company, and hence the value of the equity invested in it, can be determined by calculating the present value of the subsidiary's free cashflows.

Which of the following is the most appropriate discount rate to use when determining the enterprise value of the company?

The directors of a multinational group have decided to sell off a loss-making subsidiary and are considering the following methods of divestment:

1. Trade sale to an external buyer

2. A management buyout (MBO)

The MBO team and the external buyer have both offered the same price to the parent company for the subsidiary.

Which of the following is an advantage to the parent company of opting for a MBO compared to a trade sale as the preferred method of divestment?

TESTED 05 May 2024

Hi this is Romona Kearns from Holland and I would like to tell you that I passed my exam with the use of exams4sure dumps. I got same questions in my exam that I prepared from your test engine software. I will recommend your site to all my friends for sure.

Our all material is important and it will be handy for you. If you have short time for exam so, we are sure with the use of it you will pass it easily with good marks. If you will not pass so, you could feel free to claim your refund. We will give 100% money back guarantee if our customers will not satisfy with our products.