ACI Dealing Certificate

Last Update 3 days ago

Total Questions : 740

ACI Dealing Certificate is stable now with all latest exam questions are added 3 days ago. Incorporating 3I0-012 practice exam questions into your study plan is more than just a preparation strategy.

By familiarizing yourself with the ACI Dealing Certificate exam format, identifying knowledge gaps, applying theoretical knowledge in ACI practical scenarios, you are setting yourself up for success. 3I0-012 exam dumps provide a realistic preview, helping you to adapt your preparation strategy accordingly.

3I0-012 exam questions often include scenarios and problem-solving exercises that mirror real-world challenges. Working through 3I0-012 dumps allows you to practice pacing yourself, ensuring that you can complete all ACI Dealing Certificate exam questions within the allotted time frame without sacrificing accuracy.

The use of mobile phones from within the dealing room for transacting business:

A person who appears to be a technician asks for your help in accessing treasury systems as he has forgotten his list of access codes. The Model Code recommends:

If EUR/USD is 1.1025-28 and the 6-month swap is 112.50/113, what is the 6-month outright price?

You have written a EUR/USD knock-in option for a bank counterparty. At 6pm New York time on Friday, the instrike point is breached. This is confirmed on screens. The counterparty contacts you to confirm that the option has been knocked in.

If spot AUD/USD is quoted to you as 0.7406-09. How many AUD would you receive in exchange for USD 5,000,000 if you dealt on the price?

It is up to the vendors of electronic dealing platforms to ensure that dealers are trained to use their systems.

3-month USD/CHF is quoted at 112/110. Interest rates in Switzerland are reduced but USD rates (which are higher) are unchanged. What would you expect the 3-month forward USD/CHF rate to be?

You need to buy USD 5,000,000 against GBP and are quoted the following rates concurrently by two separate banks: 1.6045-50 and 1.6047-52. At which rate do you trade?

A 6-month SEK/NOK Swap is quoted 140/150. Spot is 0.9445. Which of the following statements is correct?

A dealer needs to buy USD against SG

D.

Of the following rates quoted to him, which is the best rate for him?A 1-month (30-day) USCP with a race value of USD 5 million is quoted at a rate of discount of 2.31%. How much is the paper worth?

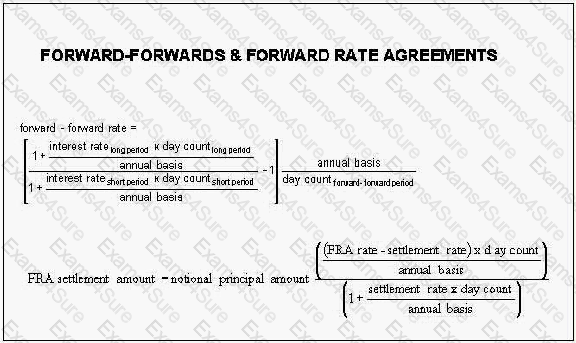

You bought a EUR 8,000,000 6x9 FRA at 4.50%. The settlement rate is 3-month (90-day) EURIBOR, which is fixed at 3.50%. What is the settlement amount at maturity?

As far as fineness and weight are concerned, what are the London Bullion Market Association (LBMA) requirements for a “good delivery bar”?

Which of the following CHF/JPY quotes that you have received is the best rate for you to buy CHF?

The tom/next GC repo rate for German government bonds is quoted to you at 1.75-80%. As collateral, you sell EUR 10,000,000.00 million nominal of the 5.25% Bund July 2012, which is worth EUR 11,260,000.00. If you have to give an initial margin of 2%, the Repurchase Price is:

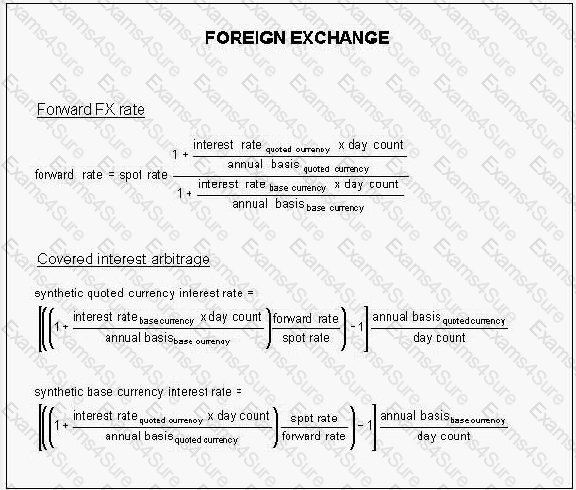

You are quoted the following market rates:

Spot GBP/USD 1.5525

9M (272-day) GBP 0.81%

9M (272-day) USD 0.55%

What are the 9-month GBP/USD forward points?

You request use of funds from your agent bank for 1 day on an amount of EUR 100,000,000.00, EONIA was 0.812% and the ECB deposit facility rate is 0.50%. What use of funds settlement amount should you expect?

How long does the Model Code recommend that tapes and other records of dealers/brokers be kept?

Assuming a flat yield curve in both currencies, when quoting a 1- to 2-month forward FX time option price in a currency pair trading at a discount to a customer:

Lending for 3 months and borrowing for 6 months creates a 3x6 forward-forward deposit. The cost of that deposit is called:

Are the forward points significantly affected by changes in the spot rate?

EUR/USD is 1.3080-83 and EUR/CHF is 1.2160-63. What price would you quote to a customer who wishes to sell CHF against USD?

Today’s spot value date is the 29th of February. What is the maturity date of a 4-month USD deposit deal today? Assume no bank holidays.

The spot/next repo rate for the 5% Bund 2018 is quoted to you at 1.75-80%. You sell bonds with a market value of EUR 5,798,692.00 through a sell/buy-back. The Repurchase Price is:

If 6-month USD/CAD forward rates are quoted at 40/45, which of the following statements is correct?

Which of the following currency risks could only be hedged by a non deliverable forward (NDF)?

A 6-month (182-day) investment of CAD 15,500,000.00 yields a return of CAD 100,000.00. What is the rate of return?

If spot NZD/CHF is quoted to you as 0.7406-09. How many NZD would you receive in exchange for CHF 5,000,000.00 if you dealt on the price?

You are paying 5% per annum paid semi-annually and receiving 6-month LIBOR on a USD 10,000,000.00 interest rate swap with exactly two years to maturity. 6-month LIBOR for the next payment date is fixed today at 4.95%. You expect 6-month LIBOR in 6 months to fix at 5.25%, in 12 months at 5.35% and in 18 months at 5.40%. What do you expect the net settlement amounts to be over the next 2 years? Assume 30-day months.

How can material divergences between the value of cash and collateral be managed in a documented sell/buy-back?

You wish to sell a customer GBP/USD for value tomorrow. How can you hedge yourself?

Which of the following is a characteristic of all liquid assets under Basel III?

You are entering into a swap as a fixed rate receiver with Party A and into an offsetting position with party

B.

All other things being equal, which of the scenarios below will lead to the greatest increase in the sum of the Credit Value Adjustments for A and B?Which one of the following best describes expected shortfall/conditional value-at-risk at the 95% level?

Which of the following statements about the Net Stable Funding Ratio is correct?

If a dealer needs to hedge an over-lent 3x6 position against 1MM dates for which the FRA is quoted 1.30-1.34% and futures at 98.64, which would be cheapest for him (ignoring margin costs on futures positions) to cover his gap?

From the following CAD rates:

1M (31-day) CAD deposit 0.95%

1x2 CAD (30-day) FRA 1.21%

2x3 CAD (31-day) FRA 2.01%

Calculate the 3-month implied cash rate.

Three of the following non-EU countries have unilaterally adopted the Euro. Which one has not?

What happens when a coupon is paid on bond collateral during the term of a sell/buy-back?

You are quoted the following market rates:

Spot EUR/USD 1.3097-00

0/N EUR/USD swap 0.08/0.11

TIN EUR/USD swap 0.29/0.34

S/N EUR/USD swap 0.10/0.13

Where can you buy EUR against USD for value tomorrow?

You are the fixed-rate payer in a plain vanilla interest rate swap. If your counterparty defaults, your exposure at default is:

Which of the following statements about “standard settlement instructions” (SSI) is correct?

The risk associated with a stock or a bond that is not correlated with events in the market is known as:

You are quoted the following rates:

Spot EUR/NOK7.5250-60

O/N EUR/NOK swap 3.10/3.20

T/N EUR/NOK swap 3.12/3.22

S/N EUR/NOK swap 9.35/9.55

At what rate can you sell EUR against NOK for value tomorrow?

The Model Code recommends that standard terms and conditions be used in legal documents. Which one of the following statements is correct?

Today’s date is Thursday 12th December. What is the spot value date? Assume no bank holidays.

Which of the following is not an officially published settlement or reference rate?

Issues relating to the bank’s liquidity management are commonly discussed in:

If you have created a ‘synthetic asset’ by buying and selling a USD/CHF swap, what have you done?

A dealer in the spot foreign exchange market has to assume that a price given to a voice broker is only valid:

Which of the following does the Model Code not recommend to prevent technical errors by etrading devices?

A CD with a face value of USD 250,000,000.00 was issued at par with a coupon of 5% for 91 days.

You buy it in the secondary market when it has 30 days remaining to maturity and is trading at

5.25%. How much do you pay?

A 3-month (90-day) NZD deposit is 2.75% and 6-month (180-day) NZD deposit is 3.00%. What is the 3x6 NZD deposit rate?

What does the Model Code say about omitting the “big figure” in voice communication?

Using the following rates:

Spot GBP/CHF1.4235-55

Spot CHF/SEK6.8815-45

3M GBP/SEK swap 140/150

What is the price for 3-month outright GBP/SEK?

What should a broker do if his quoted price is hit simultaneously by several dealers for a total amount greater than that for which the price concerned was valid?

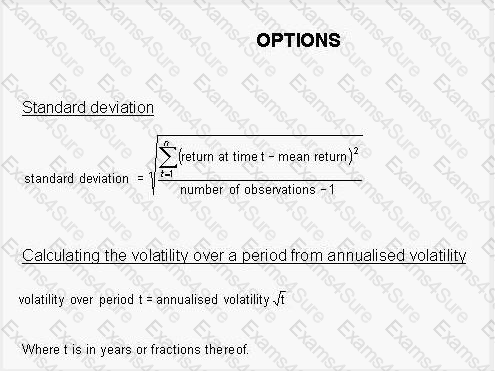

Which one of the following statements regarding the variance-covariance method for calculating value-at-risk is true?

To establish and maintain a short position in deliverable securities, you must:

Which of the following statements is false? The repo legal agreement between the two parties concerned should:

Deliberately inputting incorrect big figures into an electronic dealing platform is:

Which of the following statements reflects the Model Code on gambling or betting amongst market participants?

How many USD would you have to invest at 3.5% to be repaid USD125 million (principal plus interest) in 30 days?

Deals transacted directly or via a broker prior to 5:00 am Sydney time on Monday morning:

Gambling or betting amongst market participants has obvious dangers and:

TESTED 03 May 2024

Hi this is Romona Kearns from Holland and I would like to tell you that I passed my exam with the use of exams4sure dumps. I got same questions in my exam that I prepared from your test engine software. I will recommend your site to all my friends for sure.

Our all material is important and it will be handy for you. If you have short time for exam so, we are sure with the use of it you will pass it easily with good marks. If you will not pass so, you could feel free to claim your refund. We will give 100% money back guarantee if our customers will not satisfy with our products.