Certified Treasury Professional

Last Update 5 days ago

Total Questions : 932

Certified Treasury Professional is stable now with all latest exam questions are added 5 days ago. Incorporating CTP practice exam questions into your study plan is more than just a preparation strategy.

By familiarizing yourself with the Certified Treasury Professional exam format, identifying knowledge gaps, applying theoretical knowledge in AFP practical scenarios, you are setting yourself up for success. CTP exam dumps provide a realistic preview, helping you to adapt your preparation strategy accordingly.

CTP exam questions often include scenarios and problem-solving exercises that mirror real-world challenges. Working through CTP dumps allows you to practice pacing yourself, ensuring that you can complete all Certified Treasury Professional exam questions within the allotted time frame without sacrificing accuracy.

A treasurer has been advised that his privately held company has just lost its largest customer, which will have a significant impact on earnings. The treasurer applies an aggressive working capital strategy. Presently, the yield curve is upward sloping. Given this information, the treasurer should ensure that the company has:

An accounts payable manager has been mandated to accept all trade discount opportunities with an effective cost of discount above 25%. An invoice has been presented and approved for payment with terms of 3/5, net 30 days. What is the difference between the effective cost of discount offered, and the 25% rate set by the company?

A national retailer’s cash management system includes a field deposit system using multiple banks. To limit the impact of a failure of one of these banks, a cash manager should:

In order to increase liquidity, ABC Motor Company bundled its customers’ installment payments and resold them to other investors. This is known as:

As a result of the Sarbanes-Oxley Act, what new entity was established to sanction firms and individuals for audit violations?

A company has multiple wholly-owned subsidiaries that issue their own checks which are signed by head office staff. The company decides to move to electronic payments using their bank’s internet-based payment systems to reduce costs. Payments are now initiated by the subsidiaries. What element of the payment policy should be considered if the company still wants to maintain head office control over payments?

An equity management company’s Chief Financial Officer and Treasurer are evaluating their corporate investments and decide that they need to diversify their stock holdings to include personal care products companies. Based on their analysis, publicly-traded companies A and B stand out as choices. Company A has a beta value of 0.65 while company B has a beta value of 1.10. They decide to invest in Company

A.

What objective of their investment policy did they use to make their decision?The regional offices of ABC Company implemented a system that would allow the employees to pass information between regions in a secure fashion. This system requires that all offices have the same key in order to read messages sent electronically. Which e-commence security type is MOST LIKELY being used?

Company ABC is experiencing an increase in bank fees due to its new international customers paying by check. Nearly 15% of all deposited items are international checks. Twenty percent of the company’s checks have 1 day of float. Sixty-five percent of the company’s checks are on-us items. The company has $300,000 of deposits each day. The company’s deposits consist of both cash and checks, split evenly. On a typical day, how much of the deposit will be available immediately?

Over the past 3 years XYZ Company has expanded into multiple countries and significantly grown its banking relationships. The company now incurs significant expenses related to payment transaction costs and maintaining multiple bank connections. What should the company use to combat these rising costs?

Company ABC is a restaurant chain that has enjoyed a surge in customers’ dining with not much of a profitability increase in the last couple of years. Following a bad restaurant review, customer traffic deteriorated with not much change in profitability. Which of the following BEST describes the cost structure of the company?

PTC Corporation has determined that the threshold amount for initiating a wire transfer vs. an ACH payment for concentrating funds is $60,225. Wires cost $9.00 and save one day of float. If the opportunity cost is 5%, what is the cost of the ACH payment?

During a company’s cash flow analysis review it discovers that for every 10 new customers it gains, there is an increase of 2% in its float costs associated with the payment methods it offers. If the company pursues faster collection methods for payments, resulting in greater availability of surplus cash with a correlating decrease in the need to issue commercial paper, what risk will the company mitigate?

A hamburger patty supplier receives an order from ABC Burgers located in Minnesota. The supplier’s policy is to bill upon fulfillment of the order and not at delivery. ABC Burgers pays upon receipt of goods. A blizzard has closed the manufacturing facility and roads; delivery will be delayed by two days. Which type of float occurs between the receipt of an invoice by ABC Burgers, including the credit period, and the time ABC Burgers’ account is debited?

A cash manager at a U.S. retailer forecasts a positive collected cash position for the end of the current day. The company has an overdraft facility at 10%, a separate investment account earning 8% before taxes, an earnings credit rate of 8% and an outstanding single payment note at 9.5% maturing in 1 week. This month’s bank service fees are expected to exceed the earnings credit. Which of the following options would be the MOST economically positive for the company?

When a buyer receives goods, but payment is not due to the supplier until some later date, this is defined as:

A U.S. financial institution expects to grow at an exponential rate to become one of the largest companies in the country. It wants to hire the best talent in the industry and is willing to pay excessive compensation. In order to achieve the high growth, it is planning on charging hidden fees on mortgages, credit cards etc. Further, it wants to engage in risky practices pertaining to over-the-counter derivatives, asset-backed securities and hedge funds. The financial institution has hired an outside law firm to determine if it is feasible to escape unwanted regulation and oversight from various government entities. Which of the following regulations prohibits the financial institution from engaging in the described practices?

A portfolio manager would like to purchase U.S. 50 million of 10-year notes 3 months from now, but has heard news that the Federal Reserve will start a purchasing program of longer term treasuries that will include 10-year notes. The purchase program would likely cause a lowering of market interest rates. The manager would also like to avoid having to use margin on a daily basis. To remove the price risk that may be associated with the Federal Reserve purchasing program, the portfolio manager would MOST LIKELY enter into an:

A consumer is presented with payment options from a merchant when making a purchase. The consumer does not wish to share any information that could be later used in identity theft or fraud, while the merchant requires guaranteed payments within 24 hours with no NSFs or declined payments. Which of the following options would suit both the consumer and the merchant?

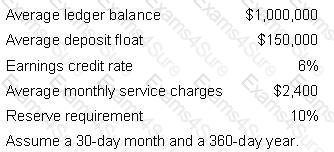

Based on the following information, what is the required collected balance to cover all monthly service charges?

Deposit Float$10,000

Reserve Requirement5%

Earnings Credit Rate15%

Monthly Service Charges$6,000

Days in month30

A residential mortgage company that wants to collect monthly payments from customers electronically via the ACH would initiate:

A public corporation may value a defined contribution plan highly because it:

Which of the following instruments simplifies the paperwork connected with loans that have multiple advance features?

A Chicago meat processor is concerned about the volatility of pork belly prices. Which of the following derivative products would be used to fix these prices within a given range?

Which agency implements monetary policy through purchases and sales of treasury securities?

Company XYZ is not sure which direction interest rates are headed. Which of the following would be MOST suitable?

A company hires an investment firm to fully underwrite a new stock issuance. Which of the parties carries the MOST risk?

During the 1970s, many companies instituted dividend reinvestment plans (DRIPS). There are many benefits of this plan. What is the one negative aspect?

Company XYZ has determined that its weighted average cost of capital is 12.5%. The capital structure of the company is made up of 75% equity and 25% debt. The before-tax cost of debt is 10%. Given a tax rate of 34%, what is XYZ's cost of common stock?

What must be measured and monitored to ensure that a company has adequate liquidity?

In which of the following international cash management methods is title for goods transferred for intercompany sales?

What is the MOST appropriate rate used as the discount rate in calculating NPV?

Which of the following is a characteristic of giro systems used in countries in Europe?

ABC Company is a national retail company and uses XYZ Bank for its collections and payroll services. XYZ has recently experienced financial problems; what is the greatest risk to ABC Company?

A large multinational company with multiple autonomous operational entities is MOST LIKELY to operate.

Company ABC has recently started to experience a significant reduction in funds availability. Which of the following is MOST LIKELY to reduce funds availability?

Company ABC decides to outsource certain activities to an unrelated company and have that company assume the associated loss exposures. What loss control technique is Company ABC using?

An olive oil producer in Macedonia is arranging for shipment of its product to an international distributor. To support this activity, the company arranges for export financing because:

A company's lockbox bank, which processes 24 hours per day, has a 6:00 P.M. ledger credit cutoff and grants same-day availability on checks drawn on Bank B that are received by 10:00 P.M. Which of the following ledger and collected credit postings would result from a Bank B check received at 11:00 P.M. on Tuesday?

Which of the following would increase if the Fed were to announce a reduction in reserve requirements?

All of the following bank products and services can simplify the preparation of the daily cash position EXCEPT:

When a company creates future receivables and/or payables that are denominated in a currency other than its home or functional currency it is faced with:

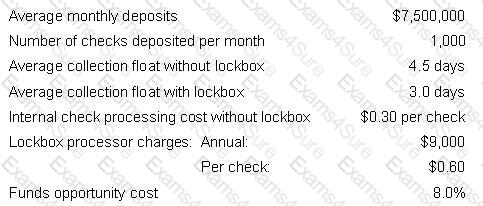

A company that is considering using a central lockbox for collections has conducted an initial study and determined the following:

What will be the annual net dollar benefit to the company if it uses a lockbox?

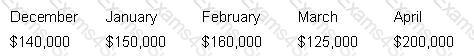

A company plans to perform an A/R cash analysis based on the following sales information:

60% of sales are collected within two months after the sale. After three months, $135,000 of January's sales has been collected. What was the percentage of January's sales collected in April?

A utility company is evaluating whether or not it should build a new plant. The process of reviewing the quantitative and qualitative factors are an example of which finance function?

If a company does not have cash available to make an interest payment on a bond, the company is experiencing difficulty with its:

A multidivisional domestic company with centralized treasury decision-making can potentially utilize intra-company lending to:

Which of the following is the MOST accurate statement regarding the passage of the Sarbanes-Oxley Act?

A multinational corporation with many FSPs requires a TMS that can display extensive and complex information in an effective manner. The corporation will be looking for a TMS with what functionality?

Which of the following is a PRIMARY responsibility of a company's risk management function?

A manufacturing company begins using just-in-time (JIT) inventory management. Which JIT-related payment process is MOST LIKELY to be implemented?

Which of the following payment instruments is initiated by the payee rather than the payor?

A UK based manufacturer has a subsidiary in Belgium and a manufacturing plant in Italy. The subsidiary wants to sell its products in Sweden. How would the UK parent best structure the movement of funds within the organization to optimize management of working capital while ensuring recourse?

A retail company is performing a risk analysis on its accepted payment types. Cash is the primary form of payment for this retailer. What is the PRIMARY issue with cash payment systems?

The PRIMARY goal of treasury management is to use which of the following efficiently?

Who has responsibility for final approval of treasury policies that have a significant impact on the organization?

A large U.S. based multinational corporation favors use of intra-company loans to repatriate funds from its foreign subsidiaries in order to take advantage of the favorable tax treatment of loans. In those countries which restrict repayment of intra-company loans the corporation may need to:

XYZ Company's cash manager is evaluating cash concentration transfer options. The company has an 8% cost of funds and $50,000 in average daily field cash receipts. The wire transfer results in the transfer of funds one day faster. Which of the following options correctly ranks the transfer choices from most cost-effective to least cost-effective?

1. Electronic depository transfer costing $1.00

2. Electronic depository transfer costing $2.50

3. Wire transfer costing $8.00

4. Wire transfer costing $15.00

A company's basic investment objectives should include all of the following EXCEPT:

A financially sound company sends wires to investors in the morning but does not receive replacement funds until the afternoon. Which facility will the company MOST LIKELY arrange with its bank to facilitate the company’s wire payment activities on any given day?

Because of the growing demand in China for oil, a transportation company decides to assume a long position on oil in hopes of generating short-term investment income. Which of the following describes the firm’s strategy?

Companies that seek out other companies that have successfully redesigned their operations are engaging in a process called:

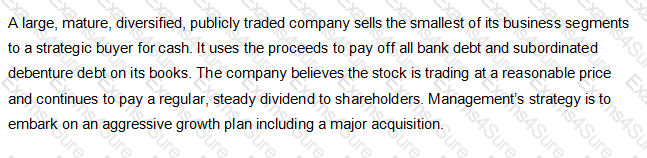

Based on the above information, before making the major acquisition, several large institutional shareholders have asked management to consider all of the following EXCEPT:

All of the following would encourage a company operating nationwide to develop multiple banking relationships EXCEPT:

Which of the following statements are true about the use of different discount rates for different types of projects?

I. Low-risk, short-term projects may be evaluated by using a short-term opportunity cost.

II. High-risk projects may be evaluated by using a discount rate that is greater than the company's normal opportunity cost.

III. A short-term investment (or borrowing) rate may be used as the company's short-term discount rate.

IV. The use of a lower discount rate for riskier projects forces riskier projects to earn higher rates of return.

The analysis of a company launching an initial public offering includes disclosure of information that may interest investors. It also includes confirmation that financial statements reflect true value under GAAP and other pertinent areas of a company’s operations. What is this analysis known as?

From a consumer's perspective, all of the following are true of both debit cards and credit cards EXCEPT:

A United States company must remit a dollar royalty payment to its Japanese subsidiary. Cash settlement of the payment would typically be made by which of the following?

A treasury project manager is tasked with improving day’s sales outstanding. The company, a major retailer, sells 70% of its products to businesses. The project manager has convinced the Treasurer to proceed with purchasing $500,000 worth of equipment to convert the checks they receive to electronic form. What did the project manager overlook in making the decision?

What type of insurance provides payments to an organization if it is unable to continue operations for some period due to an unforeseen event?

A company wishes to monitor and control office expenses incurred by its employees. Which of the following offers the BEST method of providing the employees freedom to choose different vendors while maximizing spending control?

Company A has operated a Pension Plan since 1985. Despite a recent surge in asset values, the plan remains significantly underfunded. With the passage of the Pension Protection Act of 2006, Company A will be need to:

Which cost benefit analysis technique uses the methodology to find where the present value of each project’s cash inflows equals the present value of each project’s outflows?

Which of the following are examples of covenants in loan agreements?

I. Financial ratios

II. Corporate resolutions

III. Borrower limitations

IV. Borrower obligations

Which of the following credit terms would be MOST appropriate for a seasonal product that a manufacturer wants to sell to a retailer during the product's off-season?

A company offers credit terms of net 40, with an opportunity cost of 12% to a customer. What discount would have to be offered for the customer to be indifferent between paying on Day 40 and paying with the discount on Day 10?

Which of the following short-term instruments is used to finance the import or export of goods?

The future value of $60 invested at 8% compounded per year for three years is:

What is the correct sequence of the following disbursement float events, from first to last step?

1. Check clears back to drawee bank account.

2. Check is encoded and enters the clearing system.

3. Depositor receives ledger credit.

4. Lockbox bank receives check.

The time from the deposit of a check in a bank account until the funds can be used by the payee is known as:

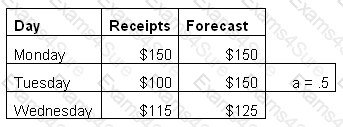

On the basis of the data above,

what is the forecast for Thursday's cash receipts, under the exponential smoothing method?

Buying a security with the intent of selling it prior to its maturity date to increase the return is an example of:

A company has a $2 million line of credit requiring a 5% compensating balance on usage. For the next year, the company projects a usage of 75% and a 10.375% interest rate. If the balance requirement is eliminated, by how many basis points will the company's effective interest rate be reduced?

A U.S. company that is expecting to receive a payment of C$1,000,000 purchased a put option of C$1,000,000 at a strike price of 1.75 C$/US$. Two days before the receipt of the payment, the spot rate is 1.85 C$/US$. To maximize its receipt of dollars, the company should do which of the following?

A good credit rating has which of the following effects on debt?

I. Improved marketability

II. Decreased cost of funds

III. Decreased maturity

IV. Increased dealer fees

The auditors of a private college are examining and auditing the college’s financial statements. The statements are not presented in accordance with GAAP. What should the auditors do?

An evaluated receipts settlement would be MOST commonly used in an environment where:

A company has negotiated a credit facility with the following terms:

What is the annual interest rate on the line of credit?

A company is interested in lowering its overall banking costs, managing netting, pooling, re-invoicing, and centralizing FX exposure at headquarters. Which of the following options will accomplish this?

A company has negotiated a credit facility with the following terms:

What is the effective annual borrowing rate for the line of credit?

Some treasury management systems are capable of initiating investment purchases and loan drawdowns automatically. The automating of these transactions is related to which of the following treasury management functions?

When projecting the closing cash position, a cash manager must estimate which of the following?

If the Federal Reserve Board increased the discount rate, you would expect:

As an internal control tool, what does the matching of an invoice to the original purchase confirm?

A merchant closes its day with a total of 100 credit card transactions of an average ticket value of $100. The interchange reimbursement fees are 2% and transaction fees are $0.05. If this merchant receives gross settlement, what would be the value of deposit to the account for that day?

The earnings allowance rate applied to collected balances is usually determined by which of the following rates?

When considering Fedwire, ACH and CHIPS as 3 different payment systems, which of the following applies only to Fedwire?

All of the following are advantages of using traditional financial ratios for analysis EXCEPT:

Which of the following MOST often contributes to the misinterpretation of DSO?

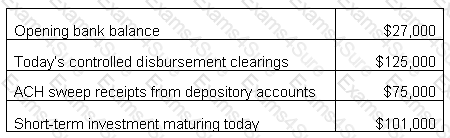

The Cash Manager of XYZ Corporation is trying to determine today’s closing cash position in order to make an investment or borrowing decision. The Cash Manager anticipates wiring $55,000 in tax payments and $63,000 in supplier payments today. Additionally, the Cash Manager is aware that a $15,000 wire was received today into the company’s concentration account from a customer and that XYZ Corp. will have to fund a bond interest payment of $200,000 in three days.

Using this information, as well as the data in the table, what is the closing cash position for XYZ Corporation?

Merchant MNO’s sales for the day total $20,000. Fifty percent are credit cards, split between Card Red and Card Blue respectively, at 65% and 35% of the card volume. The average ticket is $50. Fees paid are 2% for Card Red and 2.5% for Card Blue and a fee of $0.05 per transaction. What are the fees that MNO will pay to the issuing banks?

The relationship between debt and equity in a company's capital structure is called:

I. Banker’s acceptances

II. Commercial paper

III. U.S. Treasury bills

IV. Federal agency securities

Which of the following is the MOST usual ranking, from lowest to highest risk, of the investments listed above?

A merchant, wanting to accept credit cards as payment method, will negotiate its fees with which of the following participants?

Under a loan agreement, which of the following could be an event of default?

I. Nonpayment of interest when due

II. A material adverse change in the condition of the borrower

III. A debt-to-equity ratio above the limit specified

IV. Shortening the cure period by half

Which of the following are KEY issues to be considered when establishing a shared service center (SSC)?

I. Selecting the location

II. Comparing an SSC structure to outsourcing of a process

III. Choosing and implementing the technology for SSC

IV. Choosing the collection bank

A large multinational company recently implemented new processes to automate its treasury operations. If these changes were the direct result of comparing the company's practices with those of other companies, the activities could be considered an example of which of the following?

I. Liquidating

II. Re-engineering

III. Benchmarking

IV. Forecasting

A company has asked its marketing, payroll and sales teams to collaborate in finding a solution that could augment its customer base, reduce payroll cost and increase sales. The solution has to be market ready. Which of the following will serve all 3 purposes?

Major Manufacturing Inc. (MMI) is a manufacturer of customized restaurant equipment. MMI's supplier relations policy is to take advantage of trade discounts, when available. All suppliers offer payment terms of 1/10, net 30. MMI invoices customers at the end of its 30-day manufacturing cycle. Which of the following is the correct chronological sequence of the events listed?

1. Customer invoice is sent.

2. Supplier payment is sent.

3. Customer payment is received.

4. Order is shipped.

5. Customer order is received.

6. Supplier order is placed.

In this situation, the net earnings credit amount for the month would show:

An airline has entered into an agreement with its partners to offset receivables and payables for a specified period of time and to transmit or receive the difference via funds transfer at the end of the period. This is an example of:

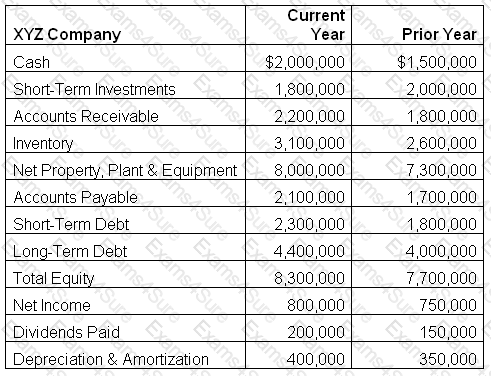

Use the financial statement for XYZ Company in the exhibit to answer this question.

What is the cash flow from operating activities for the current year?

Company XYZ has stable cash flows and sizable assets. The board of directors compared its WACC with its own industry’s averages and determined that it may be at a competitive disadvantage. In order to become more competitive, what action will XYZ MOST LIKELY take?

A portfolio manager’s investment policy states that they are not allowed to hold any investments that have extension risk. Which type of investment should the portfolio manager avoid?

A small regional bank is losing market share in fiduciary services and the CEO has decided to scale back the trust department. Which of the following is considered a core service of a trust department?

Which of the following actions would the CFO of a Canadian multinational conglomerate MOST LIKELY take to repatriate profits from its international subsidiaries?

On June 1, a manufacturing company experienced a system failure that lasted more than 24 hours. The company did not have any contingency plans in place and as a result the cash manager was unable to process the following payments: $25,000 to the p-card issuer, $125,000 for weekly payroll, $500,000 for a bond interest payment, $260,000 for the weekly vendor payments and $50,000 for the monthly utilities. The receivables were deposited at the bank; however, the cash manager does not have a way to confirm the amounts. The suppliers are threatening to stop shipments due to the delay in payment and the loss of supplier shipments threatens the company’s just-in-time production. What did the manufacturing company trigger as a result of the system failure?

Which of the following is sought from a typical cash management services Request for Proposals (RFP)?

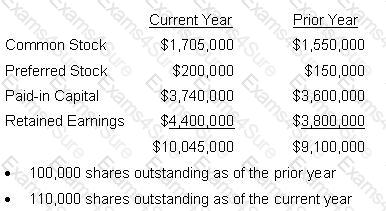

Equity section of Fisher, Inc. Financial Statement

If an investor paid $1,400.00 (excluding fees) for 75 shares of common stock, what was the market value of Fisher, Inc. at the time of purchase?

Company ABC has a concentrated investor base consisting primarily of large institutional shareholders. It would like to increase its number of smaller shareholders using the most cost effective method of raising capital available. What should Company ABC do to accomplish this goal?

The treasury manager of an auto-parts manufacturer has noticed that checks were sent to a foreign individual not on the approved vendor list. The payables manager has explained the payments but did not provide an invoice. The treasury manager did no further research and is later disciplined for:

TESTED 05 May 2024

Hi this is Romona Kearns from Holland and I would like to tell you that I passed my exam with the use of exams4sure dumps. I got same questions in my exam that I prepared from your test engine software. I will recommend your site to all my friends for sure.

Our all material is important and it will be handy for you. If you have short time for exam so, we are sure with the use of it you will pass it easily with good marks. If you will not pass so, you could feel free to claim your refund. We will give 100% money back guarantee if our customers will not satisfy with our products.