Financial Strategy

Last Update 21 hours ago

Total Questions : 393

Dive into our fully updated and stable F3 practice test platform, featuring all the latest CIMA Strategic exam questions added this week. Our preparation tool is more than just a CIMA study aid; it's a strategic advantage.

Our CIMA Strategic practice questions crafted to reflect the domains and difficulty of the actual exam. The detailed rationales explain the 'why' behind each answer, reinforcing key concepts about F3. Use this test to pinpoint which areas you need to focus your study on.

Company Z has identified four potential acquisition targets: companies A, B, C and

D.

Company Z has a current equity market value of $580 million.

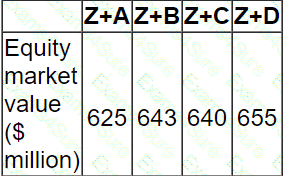

The price it would have to pay for the equity of each company is as follows:

Only one of the target companies can be acquired and the consideration will be paid in cash.

The following estimations of the new combined value of Company Z have been prepared for each acquisition before deduction of the cash consideration:

Ignoring any premium paid on acquisition, which acquisition should the directors pursue?

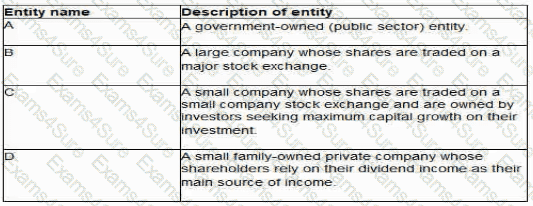

The directors of the following four entities have been discussing dividend policy:

Which of these four entities is most likely to have a residual dividend policy?

Company GDD plans to acquire Company HGG, an unlisted company which has been in business for 3 years.

Company HGG has incurred losses in its first 3 years but is expected to become highly profitable in the near future

There are no listed companies in the country operating in the same business field as Company HGG The future success of Company HGG's business and hence the future growth rate in earnings and dividends is difficult to determine

Company GDD is assessing the validity of using the dividend growth method to value Company HGG

Which THREE of the following are weaknesses of using the dividend growth model to value an unlisted company such as Company HGG?

A company has:

• 10 million $1 ordinary shares in issue

• A current share price of $5.00 a share

• A WACC of 15%

The company holds $10 million in cash. No interest is earned on this cash.

It will invest this in a project with an expected NPV of $4 million.

In a semi-strong efficient stock market, which of the following is the most likely share price immediately after the announcement of the new investment?

D has US$10 million to invest over 12 months in either USS or GBP Its options are to invest in USS at the present USS interest rate of 10 18%. or to convert the USS to GBP at the spot rate GBP1 =US$1 61 and invest in GBP at an interest rate of 6.4%.

According to the interest rate parity theory, what will the one year forward rate be?

Give your answer to three decimal places.

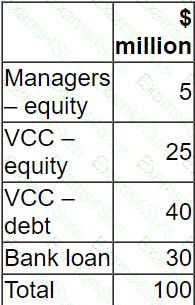

A company intends to sell one of its business units, Company R by a management buyout (MBO).

A selling price of $100 million has been agreed.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal:

The VCC requires a minimum return on its equity investment in the MBO of 30% a year on a compound basis over 5 years.

What is the minimum TOTAL equity value of Company R in 5 years time in order to meet the VCC's required return?

Give your answer to one decimal place.

$ ? million

Delta and Kappa both wish to borrow $50m.

Delta can borrow at a fixed rate of 12% or at a floating rate of the risk-free rate +3%

Kappa can borrow at 15% fixed or the risk-free rate +4%.

Delta wishes a variable rate loan and Kappa a fixed rate loan The bank for the two companies suggests a swap arrangement The two companies agree to a swap arrangement, sharing savings equally

What is the effective swap rate for each company?

A company has just received a hostile bid. Which of the following response strategies could be considered?

XYZ has a variable rate loan of $200 million on which it is paying interest of Liber ‘3%.

XYZ entered into a swap with AG bank to convert this to a fixed rate 8% loan. AB bank charges an annual commission of 0.4% for making this arrangement

Calculate the net payment from KYZ to AB bank at the end of the first year if Libor was 2% throughout the year.

Give your answer in $ million, to one decimal place.

A company has a covenant on its 5% long term corporate bond.

• Covenant - The earnings must not fall below $7 million

The bond has a nominal value of $60 million.

It is currently trading at 80% of its nominal value.

The projected earnings before interest and taxation for next year are $11.5 million.

The company retains 80% of its earnings. It pays tax at 20%.

Advise the Board of Directors which of the following covenant conditions will apply next year?

TESTED 29 Jan 2026

Hi this is Romona Kearns from Holland and I would like to tell you that I passed my exam with the use of exams4sure dumps. I got same questions in my exam that I prepared from your test engine software. I will recommend your site to all my friends for sure.

Our all material is important and it will be handy for you. If you have short time for exam so, we are sure with the use of it you will pass it easily with good marks. If you will not pass so, you could feel free to claim your refund. We will give 100% money back guarantee if our customers will not satisfy with our products.