Fundamentals of financial accounting

Last Update 5 days ago

Total Questions : 393

Fundamentals of financial accounting is stable now with all latest exam questions are added 5 days ago. Incorporating BA3 practice exam questions into your study plan is more than just a preparation strategy.

BA3 exam questions often include scenarios and problem-solving exercises that mirror real-world challenges. Working through BA3 dumps allows you to practice pacing yourself, ensuring that you can complete all Fundamentals of financial accounting practice test within the allotted time frame.

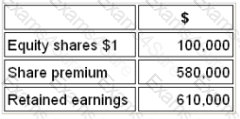

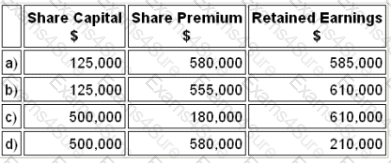

Refer to the exhibit.

A company has the following equity balances at the beginning of the year

During the year the company made a bonus issue of 1 for 4 shares

What are the equity balances after this issue?

Which of the following would be a good method of segregating the duties of staff?

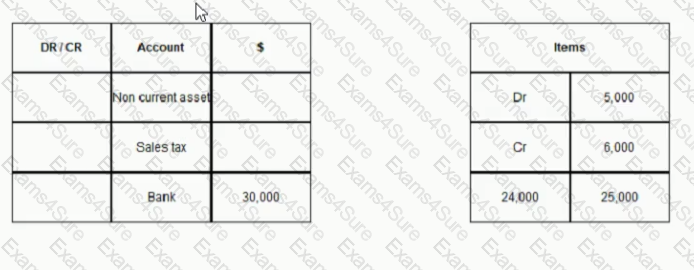

CDE, an entity registered for sales tax, purchases a piece of equipment for cash on 31 December 20X6 for $30,000 including sales tax. The sales tax rate is 20%. What is the journal entry required to record this transaction in the nominal ledger?

Place the labels in the corresponding position in the table below:

Accounting codes have proven to be very useful when recording business transactions.

Which THREE of the following does a coding system help to do?

The trial balance shows the debit total as $200 less than the credit total.

This could be due to:

The record of how the profit or loss of a company has been allocated to distributions and reserves is found in the:

Andrew is valuing the closing inventory at the lower of cost and net realizable value.

Which of the following concepts dictates his choice?

Which of the following is an example of where the materiality convention should be applied?

TESTED 27 Jul 2024

Hi this is Romona Kearns from Holland and I would like to tell you that I passed my exam with the use of exams4sure dumps. I got same questions in my exam that I prepared from your test engine software. I will recommend your site to all my friends for sure.

Our all material is important and it will be handy for you. If you have short time for exam so, we are sure with the use of it you will pass it easily with good marks. If you will not pass so, you could feel free to claim your refund. We will give 100% money back guarantee if our customers will not satisfy with our products.