Financial Reporting

Last Update 5 days ago

Total Questions : 248

Financial Reporting is stable now with all latest exam questions are added 5 days ago. Incorporating F1 practice exam questions into your study plan is more than just a preparation strategy.

F1 exam questions often include scenarios and problem-solving exercises that mirror real-world challenges. Working through F1 dumps allows you to practice pacing yourself, ensuring that you can complete all Financial Reporting practice test within the allotted time frame.

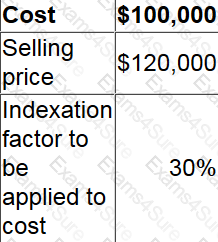

Country ZZ allows the cost of a capital asset to be adjusted for an indexation allowance which takes into consideration the effect of inflation, although the indexation allowance cannot convert a chargeable gain into a chargeable loss.

The following data relates to the sale of an asset during the year ended 31 March 20X4:

Calculate the chargeable gain or loss in respect of the sale of this asset.

Give your answer to the nearest $.

GH's tax liability at 30 June 20X3 in respect of the tax charge on the profits for the year ended 30 June 20X3 is $876,000.

There was an over provision of $105,000 that related to the tax charge on the profits for the year ending 30 June 20X2.

What amount should be shown in GH's statement of profit or loss for the year ending 30 June 20X3?

Give your answer to the nearest $.

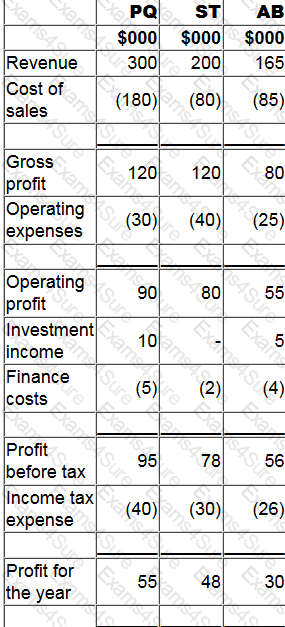

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

Calculate the amount that will be shown as the share of profit of associate in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0.

Which THREE of the following are costs that a business might incur as a result of holding insufficient inventory of raw materials?

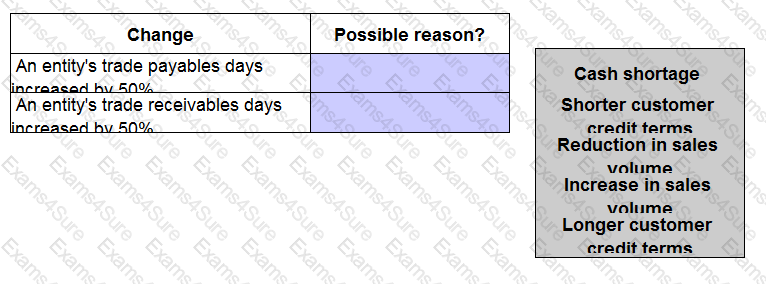

Indicate the possible reasons for the changes identified below to working capital ratios by placing the appropriate reason against each change.

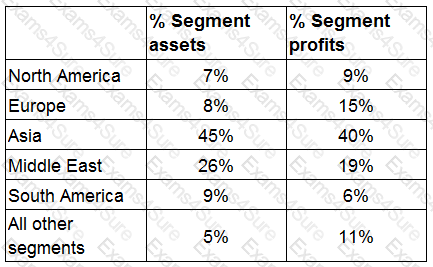

OP has five main geographic segments and reports segmental information in accordance with IFRS 8 Operating Segments.

Which THREE of the following would be regarded as operating segments of OP in accordance with IFRS 8?

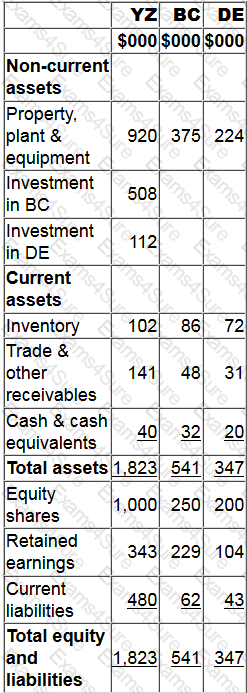

Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

YZ purchased 90% of BC's equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC's retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE's equity shares on 1 April 20X1 for $112,000. DE's retained earnings at 1 April 20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC's inventory at 31 March 20X2.

Calculate the value of the investment in associate to be recognised in the consolidated statement of financial position at 31 March 20X2.

Give your answer to nearest whole $.

Which of the following methods could be used by a tax authority to reduce tax evasion and avoidance?

Which THREE of the following must an auditor consider in order to form an opinion on the truth and fairness of an entity's financial statements?

TESTED 27 Jul 2024

Hi this is Romona Kearns from Holland and I would like to tell you that I passed my exam with the use of exams4sure dumps. I got same questions in my exam that I prepared from your test engine software. I will recommend your site to all my friends for sure.

Our all material is important and it will be handy for you. If you have short time for exam so, we are sure with the use of it you will pass it easily with good marks. If you will not pass so, you could feel free to claim your refund. We will give 100% money back guarantee if our customers will not satisfy with our products.