F2 Advanced Financial Reporting

Last Update 5 days ago

Total Questions : 268

F2 Advanced Financial Reporting is stable now with all latest exam questions are added 5 days ago. Incorporating F2 practice exam questions into your study plan is more than just a preparation strategy.

F2 exam questions often include scenarios and problem-solving exercises that mirror real-world challenges. Working through F2 dumps allows you to practice pacing yourself, ensuring that you can complete all F2 Advanced Financial Reporting practice test within the allotted time frame.

Mr D, a CIMA qualified accountant, is working on the preparation of a long term profit forecast required by the local stock market prior to a new share issue of equity shares. At the most recent board meeting the directors requested that the forecast be inflated. In Mr D's view this would grossly overestimate the forecast profit. The board intends to publish the revised inflated forecast.

Which THREE of the following are the ethical options available to Mr D in this situation?

XY purchased $100,000 of quoted 8% bonds in the current year which it intends to hold until redemption.

Which of the following identifies the correct classification and subsequent measurement basis for this financial instrument?

XY has in issue a 6% convertible bond which is redeemable at par or convertible into equity shares in one year's time. The conversion terms are 20 equity shares for each $100 of convertible bond. The conversion value in one year's time is expected to be $105 per $100 nominal of the bond based on the current share price of $5.25.

Which of the following statements about the bond is correct?

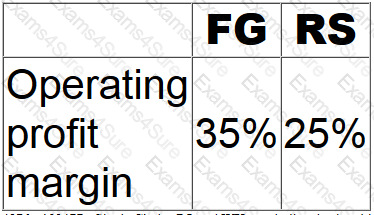

FG and RS operate in the same retail sector within the same country and are of a similar size. The following ratios have been calculated based on the financial statements for the year ended 30 September 20X4:

Which of the following factors would limit the usefulness of these ratios as a basis for assessing the comparative performances of FG and RS?

Which of the following reduce the usefulness of ratio analysis when comparing entities that operate in the same industry? Select ALL that apply.

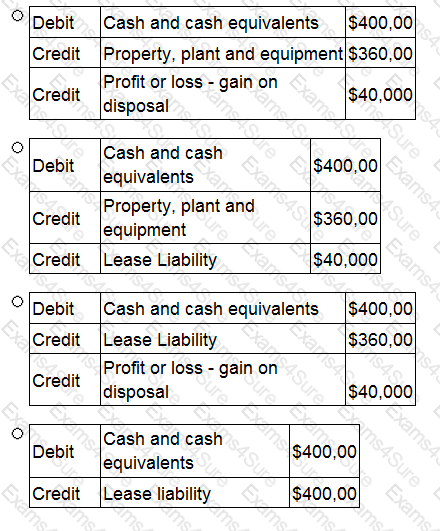

ST has sold its main office property, which had a carrying value of $360,000, to AB, a property management entity.

The property was sold for $400,000 which is equal to its fair value and was immediately leased back under an operating lease agreement.

Which of the following journals will record this transaction?

AB acquired an investment in a debt instrument on 1 January 20X5 at its nominal value of $25,000, which it intends to hold until maturity. The instrument carried a fixed coupon interest rate of 5%, payable in arrears. Transactions costs of $5,000 were paid in respect of this investment. The effective interest rate applicable to this instrument was estimated at 9%.

Calculate the value of this investment that AB will include in its statement of financial position at 31 December 20X5.

Give your answer to the nearest whole number.

$ ?

The basic earning per share computed by a company for year ended 31st March 20X7 is £2 per share. The company had certain convertible debentures outstanding as on 31st March 20X7. The conversion of

debentures to equity shares would result in the earnings per share to be £2.2. Which of the following should the company disclose?

GH's financial statements show the following:

What is the value of the dividend received from the associate to be included in GH's consolidated statement of cash flows for the year?

Give your answer to the nearest $000.

$ ? 000

LM acquired 15% of the equity share capital of ST on 1 January 20X6 for $18 million. LM acquired a further 50% of the equity share capital of ST for $50 million on 1 January 20X7 when the fair value of ST's net assets was $82 million. The original 15% investment in ST had a fair value of $20 million at 1 January 20X7. The non controlling interest in ST was measured at its fair value of $30 million at the date control in ST was acquired.

Calculate the goodwill arising on the acquisition of ST that LM included in its consolidated financial statements at 31 December 20X7.

Give your answer to the nearest $ million.

$ ? million

TESTED 27 Jul 2024

Hi this is Romona Kearns from Holland and I would like to tell you that I passed my exam with the use of exams4sure dumps. I got same questions in my exam that I prepared from your test engine software. I will recommend your site to all my friends for sure.

Our all material is important and it will be handy for you. If you have short time for exam so, we are sure with the use of it you will pass it easily with good marks. If you will not pass so, you could feel free to claim your refund. We will give 100% money back guarantee if our customers will not satisfy with our products.